March 23, 2016

Risk and Return

The Unexpectedly High Expected Return of Global Equities

It seems just about everyone I talk to these days is underwhelmed by the long-term expected return of the global stock market. I too am more worried than normal about owning equities. However, my defensiveness arises from their negative momentum, not their valuation, which I see as surprisingly attractive.

The valuation picture is blurred by the dramatic divergence between US and non-US equities. For the past four and half years, the US equity market has outpaced non-US equities by more than 10% a year. After that relative outperformance, US equities do appear overvalued, but the attractive valuation of non-US markets more than compensates in a global portfolio.

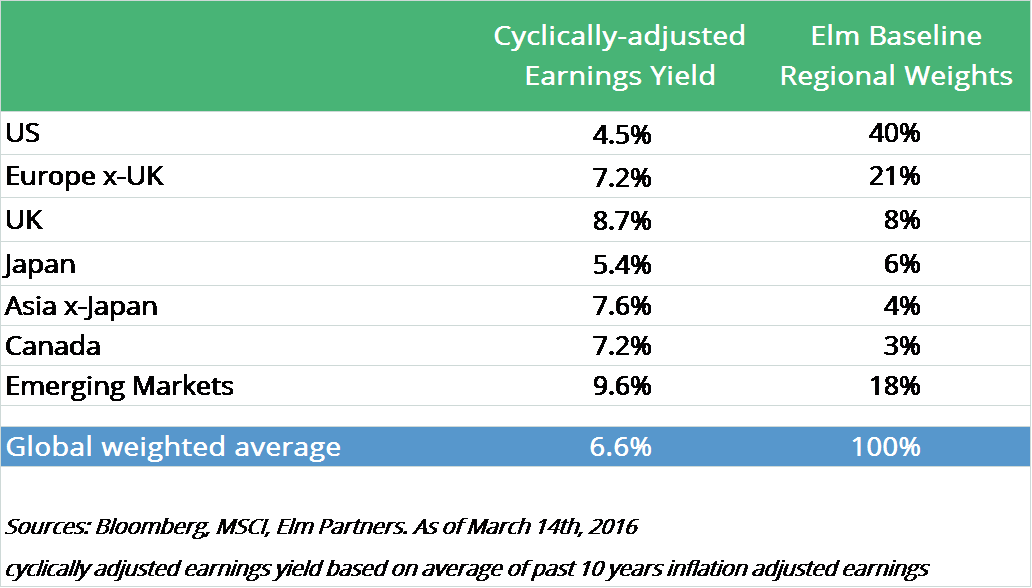

The table below shows the cyclically adjusted earnings yields (using the past 10 years of earnings) of each regional equity market. The Baseline regional weights I’m using fall in between the weights published by MSCI and those calculated by Bloomberg using their WCAP function.1

The earnings yield of the global equity market is 6.6%. To get to an estimate of the long-term expected real return, I assume that 60% of earnings can be paid out in dividends (besides sounding like a reasonable assumption, it also happens to be the average payout ratio from 1915 to 2015 in the US), which will grow at about 1.5% above inflation in the long term. Many observers prefer the even simpler estimate of just using the earnings yield itself, which is 6.6%, but I prefer basing the estimate on cash flow to investors, which is generally more conservative.

This results in 5.5% for the long-term expected real return for global equities (6.6% * 0.6 + 1.5% ).2

So how attractive is a 5.5% expected return above inflation? Here are four perspectives to consider:

- US equities returned 5.4% after inflation in the 50 years from 1965 to 2015, which many people view as having been a good time to be an equity investor (although not nearly as good as the 8.2% from 1915 to 1965).

- The chart at the top shows that 5.5% is well above the average expected return of 4.5%. It is in the top decile of expected returns calculated this way since 1985, a period of time longer than the careers of 80% of the people currently employed in the finance industry.3 We expect the average expected return prior to 1985 would be higher, but we don’t have readily available non-US data to extend the chart further into the past.

- By contrast, other assets, such as fixed income and real estate, are currently offering low expected real returns, in the bottom decile of expected returns over the past 30 years. It is difficult to come up with a simple prospective measure of expected real returns for alternatives such as hedge funds, but they certainly have been struggling recently to generate the attractive returns they produced in the 80s and 90s.

- Caution: equities can get a lot cheaper, quickly. Just a month ago, global equities were more than 10% lower than they are now, in case we need any reminder. While 5.5% appears attractive as a long term expected real return, we need to keep in mind that we may see much higher expected returns than that in the future.

Bottom line:

Global equities are pretty attractively valued, and when they enter a period of positive momentum, we’ll probably see very healthy returns.

- MSCI bases its weights on strict investible market cap data, while Bloomberg bases theirs on unrestricted market cap. The Baseline weights used here go beyond market cap, using other economically relevant data to compute weights. See this note for details, and here for a further comparison of weighting schemes.

- Based on the belief that earnings and dividends will grow at less than the rate of real GDP growth due to various slippages. For a more detailed discussion, watch this video, and read this short note. Furthermore, if we think of this as the central case in the return distribution, and if we believe the long-term return is distributed relative symmetrically around this value, then there is a convexity adjustment that makes investing in equities even more attractive.

A back-of-the-envelope illustration is to note that if we thought there were two equally likely long term (say 30-year) outcomes for the real return, of say, 5.5% + 2% and 5.5% – 2% , we would see that the return associated with the expected value of equities would be 6.02%, or 0.52% higher than the 5.5% base case.

- From US BLS data, here.

Previous

Previous