December 2, 2016

Investing 101

Do Index Buyers Make Over-Valued Stocks More Over-Valued?

For more than 60 years, the capitalization-weighted market portfolio has been a cornerstone of the modern theory of investing. As it inexorably takes its place as a cornerstone of investment practice, it has been subject to a litany of increasingly strident criticisms, such as the recent Sanford C. Bernstein paper, “The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism.” If the purpose of such notes is to get press attention, they are successful, but if the purpose is to help our understanding of how markets function, they generally fall short.1

In this note, I want to dispel one frequently voiced myth about indexing, namely that when investors put their money into broad, market-cap weighted index funds or ETFs, it has the unintended consequence of increasing the aggregate mis-valuation in the market, by making over-valued equities more over-valued and under-valued ones more under-valued.2 For example, Timothy O’Neill, the global co-head of Goldman Sachs’ investment-management division, called indexing “a bubble machine” which “guarantees that the most valuable company stays the most valuable, and gets more valuable and keeps going up.”3 It’s a good story, but on closer inspection, it’s not true.

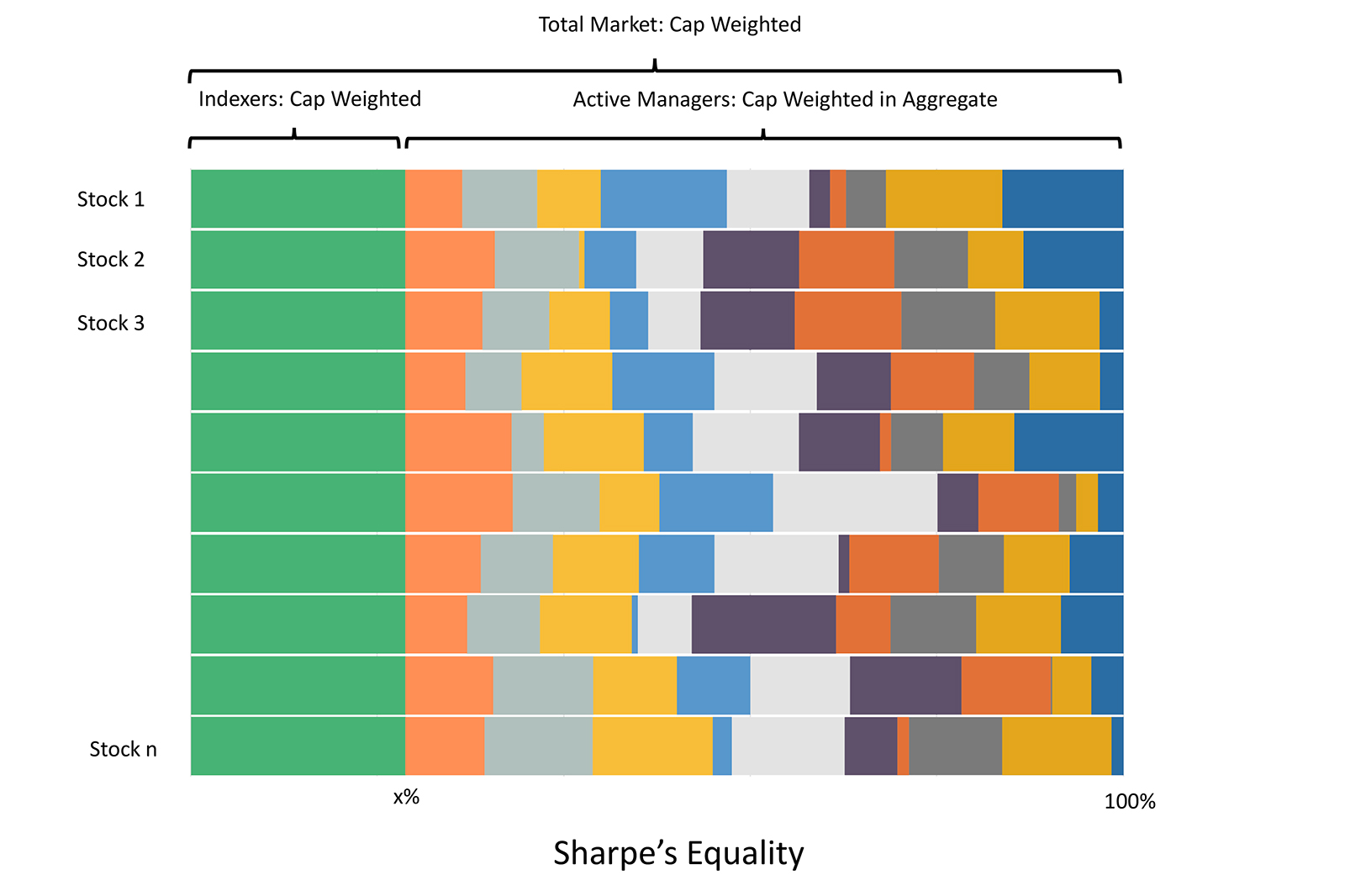

To see why, think of the equity market as being owned by two kinds of investors: a) market cap indexers, who own every equity in the market in proportion to its market capitalization, and, b) active managers, each of whom owns a portfolio of equities that matches his or her assessment of which are the best ones to own or avoid. We can see that while each active manager will own a portfolio that diverges from market cap weights, the holdings of the active managers in aggregate must by definition be in proportion to market cap weights.

As William Sharpe explained in his seminal 1991 note, “The Arithmetic of Active Management”:4 by definition, since the portfolio representing the total market and the portfolio of indexers are both capitalization weighted, it follows that active managers have to be capitalization weighted in aggregate too.5

Let’s dig deeper into these flows that worry the indexing critics. There are two ways that an investor can buy an index fund: a) with fresh money, for example from a pay-check, or b) from the sale of an actively managed holding of equities. In the case of a fresh money purchase, if the seller of the index fund is an indexer too, then the whole index as a package changes hands, and that shouldn’t have any impact on relative prices of individual equities. Furthermore, since it’s spread out over the whole market, an index trade should also have less price impact than an investor buying a concentrated subset of the equity market. If, however, the sale comes from a cross-section of active managers, then the new indexer needs to buy five times as much of a stock that has five times the market cap compared to another.

There are two reasons why this should not increase aggregate market mis-valuation: 1) to the extent that this buying has price impact, wouldn’t our best guess be that a stock that is five times as big as another can absorb five times the buying with the same percentage price impact? And, if you don’t agree with that, then 2) assuming that many stocks are mis-valued, why should we expect that big companies are more over-valued in percentage terms than small companies? Isn’t it more plausible that some large companies are over-valued and some are under-valued, and likewise for smaller companies? While it is true that an over-valued company has a market value that is larger than its fair value, for any given equity we don’t know a priori whether it is over-valued or under-valued, a subtle but critical distinction.

This reasoning was explained in greater depth by Harvard Professor André Perold in a 2007 note defending market cap weighted indexing: “Holding a stock in proportion to its capitalization weight does not change the likelihood that the stock is overvalued or undervalued. The notion that capitalization weighting imposes an intrinsic drag on performance is, accordingly, false.” 6

Let’s turn to the second case, that of an investor who decides to sell his actively managed holdings and move into an index fund. We should only be concerned here if we believe the investor somehow manages to sell the active managers who hold relatively under-valued equities. Even though all active managers think they own under-valued equities, we’ve already shown this cannot be the case in aggregate, because active managers as a group can’t do anything other than own the market index.

The intransigent critic of indexing might counter that that the investor who moves into an index fund will tend to sell his active holdings that have performed the worst recently, which would have the effect of pushing those stocks down even further. This argument requires us to believe that the active manager who is doing the worst is also somehow most likely to be the best at identifying under-valued equities. If we believe that investors in actively managed portfolios tend to chase returns (and we do7), then the effect of the return chaser moving into an index fund results in less of the pressure that the critic of indexing is concerned about. This is because the return chaser is doing half the chasing by not buying the actively managed portfolio that has done well recently. Better still, by giving up return chasing by becoming an index investor, he will be less likely to cause mis-valuation in the future.

In this note, we have used a simplified representation of the marketplace to explain why the argument that investor flows into broad, market-cap weighted indexes make mis-valued equities more mis-valued is not correct. Of course, the real world is not so simple; investors frequently use index funds and ETFs to get exposure to narrowly defined indexes, such as utilities or REITs, or as part of active asset allocation approach (see our recent note on Active Index Investing). These uses of index products are worthy of attention (and are the main focus of our business at Elm Partners), but they don’t turn the fallacy into a truth in the case of broad, market cap weighted index funds, which has been the focus of this note, and represent the vast majority of index fund and ETF assets.

- See this WSJ article (Nov 24th, 2016) by Burton Malkiel (Princeton professor and author of “A Random Walk Down Wall Street”) for a critique of the Sanford C. Bernstein note.

- In the case of flows into narrowly defined “index” baskets, such as utilities or REITs, as we pointed out in our note “What’s up with REITs?” in July, this is better thought of as active management rather than broad market cap indexing and as with all actively managed investing, it can indeed impact relative valuations.

- James Ledbetter, “Is Passive Investment Actively Hurting the Economy?” The New Yorker, March 9, 2016.

- William Sharpe, “The Arithmetic of Active Management,” Financial Analysts’ Journal, 1991:

“Each passive manager will obtain precisely the market return, before costs. From this, it follows (as the night from the day) that the return on the average actively managed dollar must equal the market return. Why? Because the market return must equal a weighted average of the returns on the passive and active segments of the market. If the first two returns are the same, the third must be also.” - Lasse Pedersen, in “Sharpening the Arithmetic of Active Management”, SSRN.com, (2016), argues that Sharpe’s equality does not hold in general. In the case of a well-constructed, well-managed index, the effects that Pedersen lists are small enough to ignore for the purpose to which we are applying Sharpe’s equality.

- André Perold, “Fundamentally Flawed Indexing,” Financial Analysts Journal, volume 63, number 6, November/December 2007. Professor Perold was responding to the theory proposed by Robert Arnott (and others, including Jeremy Siegel) that,

“No longer must investors suffer a performance drag by settling for an index that inherently overweights every overvalued company and underweights every undervalued one. With due respect to the pioneers in finance theory and the cap-weighted indexers, there is a better way.”

Page 41: Arnott, Robert. 2006. “An Overwrought Orthodoxy.” Institutional Investor (18 December): 36–41. - For a more detailed discussion of return chasing, see our research paper on SSRN.com and this blog post: Return Chasing Can Be Hazardous to Your Wealth.

Previous

Previous