November 9, 2017

Risk and Return

The Chemistry of 10% More

By Victor Haghani 1

A few nights ago at the dinner table, I was ritually lamenting my unsuccessful efforts to lose a few pounds. My son Mark, now a high school senior, posed a good question — the kind I’ve learned to think about very carefully. If I lost 5 pounds of fat, where would it go? After letting me flail around a bit, he gave me the answer (hint: neither heat release nor bathroom visits are correct answers.2). Turns out we lose most of the weight by exhaling CO2. Simple. So, if you want to lose weight, don’t hold your breath!

This reminded me of a similarly “simple” question my friend Larry Hilibrand asked me about 10 years ago that also involved a “conservation of mass” principle. In a world with two assets — cash and equities — how can investors in aggregate increase their allocation to equities, given that for every buyer there has to be a seller (assuming companies aren’t issuing or buying back shares), and so cash can’t come into or leave the market?

I recall some floundering back then too, before the obvious came into view: the price of equities must go up. I thought I was off the hook, but there was one more question: Just how much do equities need to go up if investors in aggregate have 50% in equities and decide they want to increase that to 60%? I encourage you to give it a quick guess before doing the math.

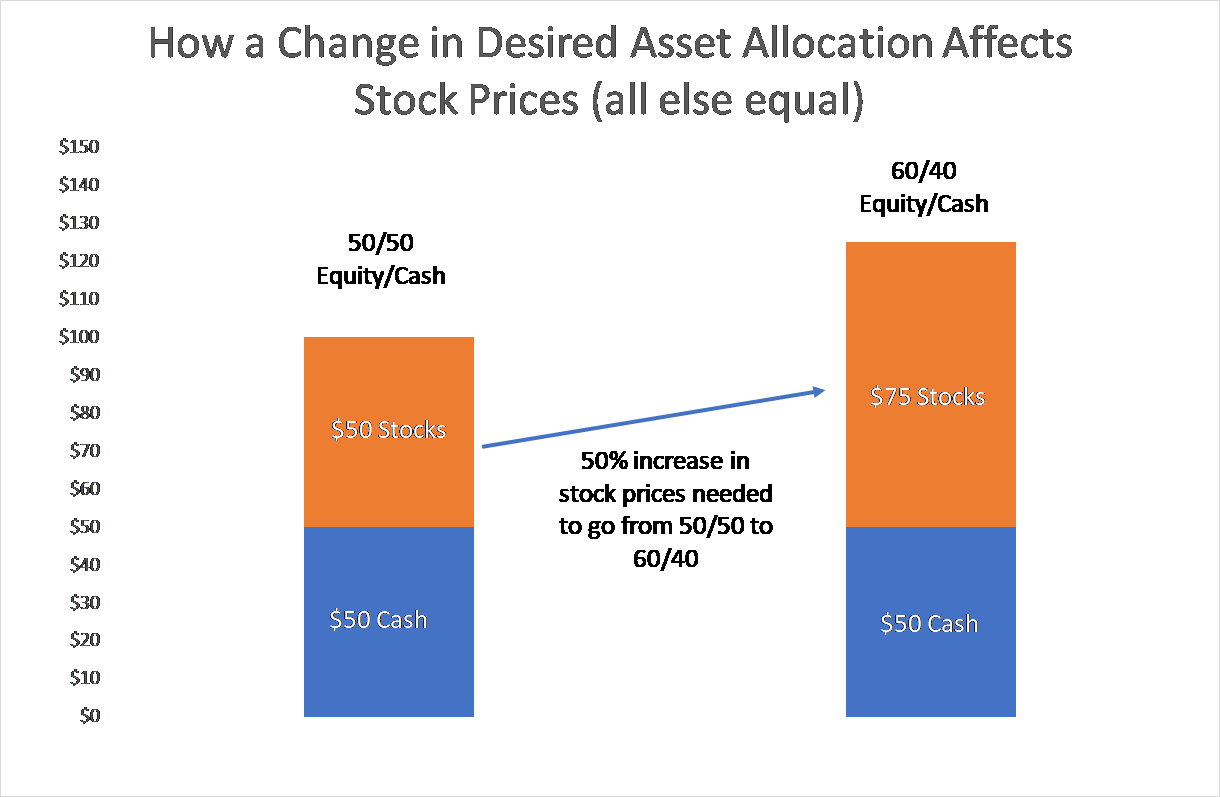

There are a few ways to figure it out, one being to consider that an investor holding $50 in equities and $50 in cash will need the original holding of cash to become 40% of the new total portfolio value after equities go up in price. So, her new total portfolio value would need to be $50 / 0.4 = $125 . The only way for that to happen is for equities to rise in value to be worth $75. That’s a 50% gain, as you can see in the chart below. I don’t know about you, but my guess was a lot lower than 50%.

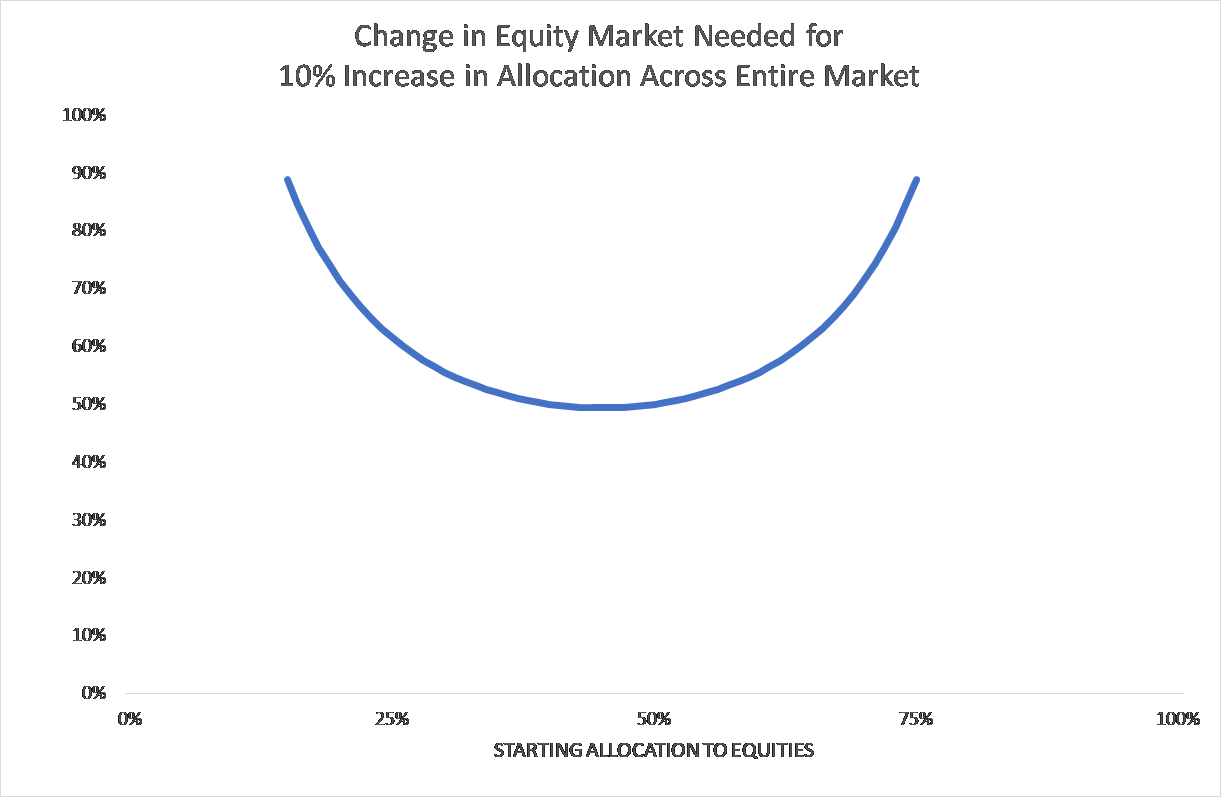

And, notice from the chart below that a 50% starting allocation is where this impact is the smallest (see the footnote below if you want a formula).3

Of course, the same math holds if investors all want to reduce their allocation to equities. From the same starting allocation of 50%, equities would need to drop by 33.3% for everyone to wind up with a 40/60 equity/cash allocation.4

In practice, the impact would be dampened by companies issuing or buying back shares, although it’s worth noting that IPOs in the US have averaged only 0.25% of total US market capitalization annually over the past ten years.5

However, in the short term, return-chasing investors, who estimate future expected returns based on historical performance, may have the opposite impact and actually put more fuel on the fire.6

This paradigm is a gross over-simplification of reality, but I’ve found it useful, and unexpected.

- Victor is the Founder and CIO of Elm Partners. Past returns are not indicative of future performance. This not is not an offer or solicitation to invest.

A big thank you to Larry Hilibrand, who provided the idea for this note, as well as valuable comments in drafting it, and to James White for helping me make it shorter.

- Heat release would imply a bodily nuclear reaction, and the stuff that leaves us was largely never part of us to lose. And here’s a YouTube video titled Mathematics of Weight Loss if you want a more complete answer. Also, thank you to Lasse Pedersen who pointed me to the even more beautiful chemistry and physics of the question, “Where does a tree get its mass from?” In this clip from BBC series Fun to Imagine (1983), the late Richard Feynman, with his infectious exuberance, explains

“People look at a tree and think it comes out of the ground, that plants grow out of the ground…if you ask, where does the substance [of the tree] come from? You find out…trees come out of the air!”

- The equity price change needed to change aggregate asset allocation by ∆% from a starting allocation of E0 is: ((1 – E0)/(1 – (E0 + ∆)) – (1 – E0)) / E0 – 1 ≈ for small ∆ , and min occurs at E0 = 50% .

- The answer is symmetric in log-space, as ln(1.5) = -ln(0.67) , suggesting a 33.3% drop in is the same amount as a 50% gain in log space.

- “Value of initial public offerings (IPOs) in the United States from 2000 to 2021”.

- At Elm, we strongly believe in estimating equity returns looking forward, rather than backwards, as discussed in this video, The Most Important Number You Won’t Find in the WSJ. Even investors who use a long historical window for their estimate will find that a doubling of the market will increase the historical 20-year return by over 3.5% per annum.

Previous

Previous