September 25, 2019

How Elm Works

Home Biased: A Case for More Indexing

By Victor Haghani and James White 1

Home Bias refers to the tendency to invest more heavily in one’s domestic equity market than global market-value proportions would suggest. When Warren Buffett advises his heirs to put 90% of their inheritance in the S&P 500 and the rest in US Treasuries, that’s an (extreme) example of the kind of Home Bias we’re talking about. At the other end of the spectrum, an investor from Switzerland investing even 10% of her wealth in Swiss stocks would be showing a high degree of Home Bias as well.

Whether or not home-biased investing makes sense, the fact is that people in pretty much every country do it. Our question is: if everyone’s doing it, does it matter? Or if everyone equally over-weights their domestic market does it all pretty much wash out, with the over-weights cancelling out the under-weights?

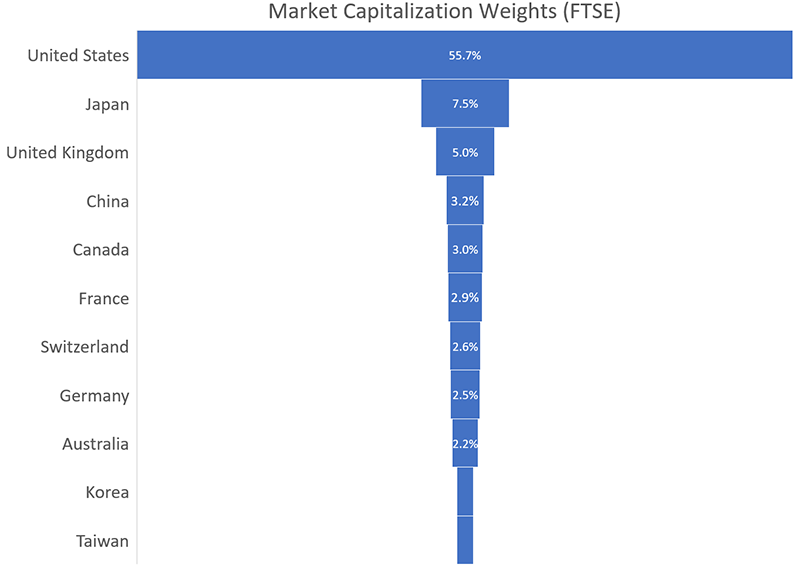

Let’s address the question with a stylized thought experiment, based loosely on Home Bias surveys. Such studies indicate that US investors invest 80% – 85% in the US market. In smaller markets, such as the UK and Canada, investors allocate about 50% of their equity investments domestically, an even larger divergence from market capitalization weights, as can be seen by comparison with the chart below.2

We start by assuming a world with no home bias, and eleven national markets with a total value of $100: a Big market weighing in at 50% of the total, and ten Small markets representing 5% each.3 We’ll also assume that investor wealth lines up with the size of their respective markets.

Now we’re going to flip a switch and turn Home Bias on: Big market investors now want to be 80% invested in their domestic market, 30% above market cap weight. The ten Small markets exhibit even stronger Home Bias, wanting to be 50% invested in their home market, 45% above their 5% weight. The table below shows how the numbers play out4:

| Big Market | Small Markets (Combined) |

|

| Market Value: | $50 | $50 |

| Big Investors’ desired allocation: |

$40 | $10 |

| Small Investors’ desired allocation: |

$13 | $37 |

| Excess Demand: | $3 | $(3) |

By flipping the Home Bias switch we’ve created a supply-and-demand problem: the Big market isn’t currently big enough to take the $40 from domestic investors plus the $13 from the Small investors, as this adds up to $53 and the market-value is only $50. The Small markets in aggregate will have a corresponding shortfall in demand.5 We can see that if Big investors want to own 80% of the $50 of their market, then all that’s left for the Small investors combined is $10 of the Big market, so at most they can have a 20% allocation to the Big market. Any greater desired allocation creates excess demand for the Big market.

Ultimately, this conundrum must be resolved by market values changing: specifically the Big market going up in value relative to the Small markets. All else equal it would have to go up quite a lot: 60%, from $50 to $80 if we hold the Small markets constant.6 The increase in Big market value could be accomplished either through rising prices or through new issuance. If prices rise, this would mean a reduction in the long-term expected return of the Big relative to the Small market of around 1.5% pa, a very sizable impact assuming both markets had expected returns around 4% without the Home Bias distortion. If instead there’s new issuance, such issuance would represent less attractive investment opportunities at the margin than previously outstanding equity, resulting again in lower expected returns for Big market equities.7

Conclusion

We read so much about how indexing is causing distortions in markets, but we’ve seen here how not indexing can itself lead to significant distortions. If there were less home bias and more passive investing in line with global market-value proportions, US equity investors would likely enjoy lower relative valuations and higher expected returns. While we agree with Mr. Buffett’s advice to non-professional investors that indexing is the way to go, we wish he’d have encouraged his disciples to take a more worldly perspective.

- This not is not an offer or solicitation to invest, nor should this be construed in any way as tax advice. Past returns are not indicative of future performance.

Thank you to Vlad Ragulin, Nir Kaissar, Aneet Chachra and Jeff Rosenbluth for their helpful comments.

- Figures vary across studies, and most are based on data which is 15-20 years old. For example, see these articles: Home Bias in Global Bond and Equity Markets (2006 working paper), Forbes 2018 and this from Vanguard: The Role of Home Bias in Global Asset Allocation Decisions (2012).

Also, even the fraction of global market cap represented by the US is debated, with some analysts suggesting that 30%, the raw weight excluding free-float and investability adjustments made by FTSE and MSCI, is the more appropriate weight to use.

- Equivalently, we could have started out with a world with 100% home bias, in which investors allocate 100% of their equity investments to their domestic equity markets. Relaxing the assumption that wealth is proportional to domestic market value will increase (decrease) the imbalance caused by Home Bias if wealth in the Big market is greater (less) than it would be under the proportional assumption.

- The Big market investors want to put $40 into their home market, leaving $1 to invest in each of the ten Small markets. The Small market investors want to put $2.50 into each of their home markets, and allocate their other $2.50 of investments according to market cap weights – so $1.32 (50/95) into the Big market for a total of $13, and the rest, $1.18, split equally among the other nine Small markets.

- More generally, with one Big market making up 50% of the total market, and many small ones comprising the other 50%, the Home Bias deviation from market weight in the Small markets needs to be two times the deviation in the Big market to balance out. Any Small market Home Bias less than that results in excess demand for the Big market (and vice versa). The formula for the balancing amount of Small market Home Bias as a function of Big market Home Bias and the Market Weights of the Big and Small markets is:HBSmall = 1 – (1 – HBBig)(1-MWSmall)/MWBigwhere HB is Home Bias, and MW is Market Weight.

- This result depends on the choice of starting point and assumptions regarding domestic wealth. One way we can get this result is by making the simplifying-but-imprecise assumption that domestic wealth moves in line with the value of the home market.

Alternatively, we can arrive at this result with the assumption that investors initially exhibit 100% home bias, and that market weights are $50 for the Big market and $5 for the Small markets, and then investors change to wanting to have 80% in the domestic market for the Big investors and 50% in the Small market for the Small investors. To arrive at balance, holding the value of the Small markets constant, the Big market needs to jump to a value of $80. If we allow both the Big and Small market values to change, there are an infinite set of moves of Big and Small markets that would accomplish the balancing, such as Big up 20% and Small down 25%.

- Another flavor of this resolution is for equity long-short funds to short the Big market and go long the Small markets, but again, this presumably would require an inducement in terms of a positive expected return spread between the Big and Small equity markets.

Previous

Previous