August 20, 2019

Indexing

Do US Industry-Sector Weights Explain the Higher Valuation of US vs non-US Equities?

By Victor Haghani and James White 1

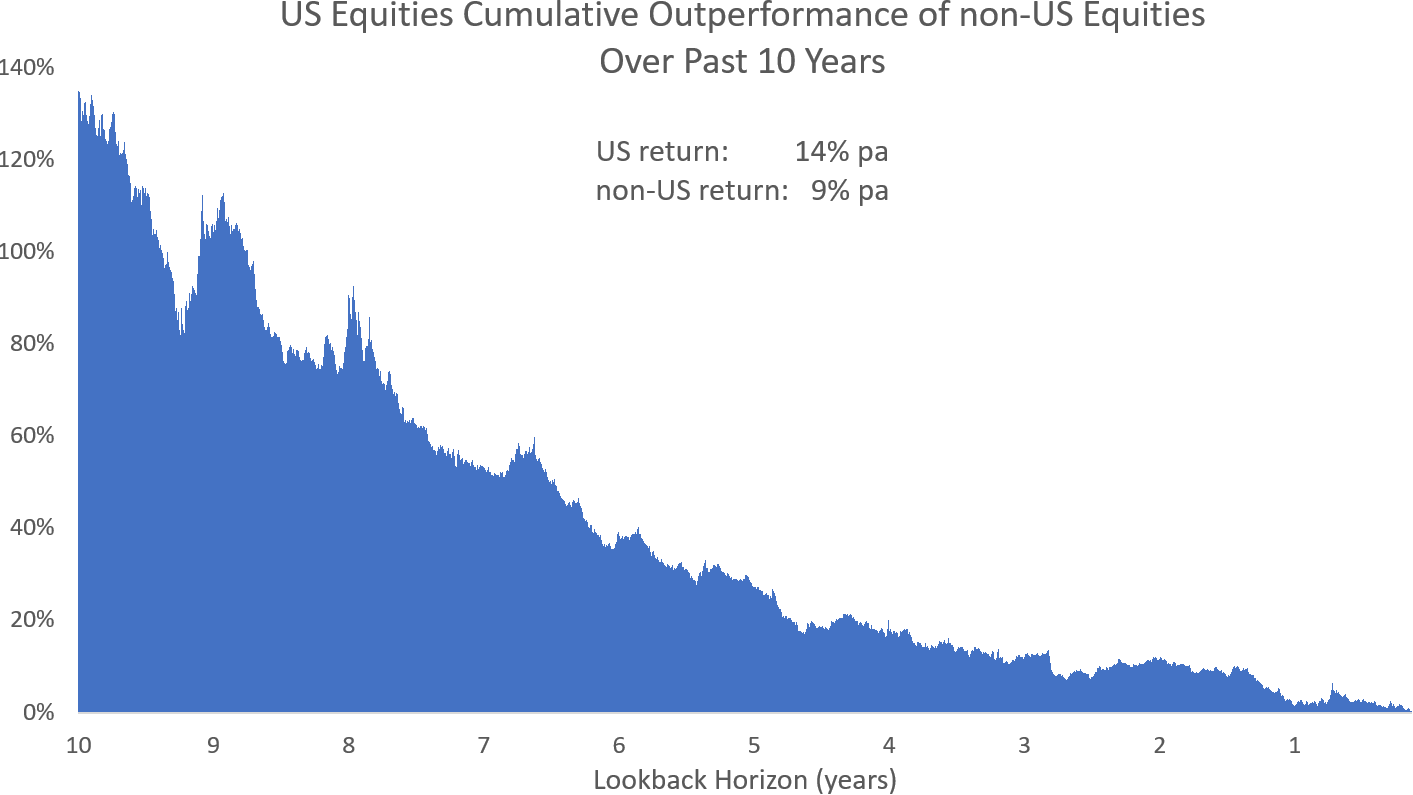

Global equity market Investors are acutely aware of the tremendous outperformance of US equities versus non-US equities over the past ten years, as illustrated in the chart below.

About 2/3 of this 135% cumulative outperformance is accounted for by higher earnings per share growth of US versus non-US equities.2 The remaining 1/3 is attributable to the relative change in earnings multiples, leaving the one-year trailing Earnings Yield of US equities at 4.9%, 2% lower than the 6.9% for non-US equities.3 The difference in the 10-year cyclically-adjusted Earnings Yield is even wider, at roughly 3%.

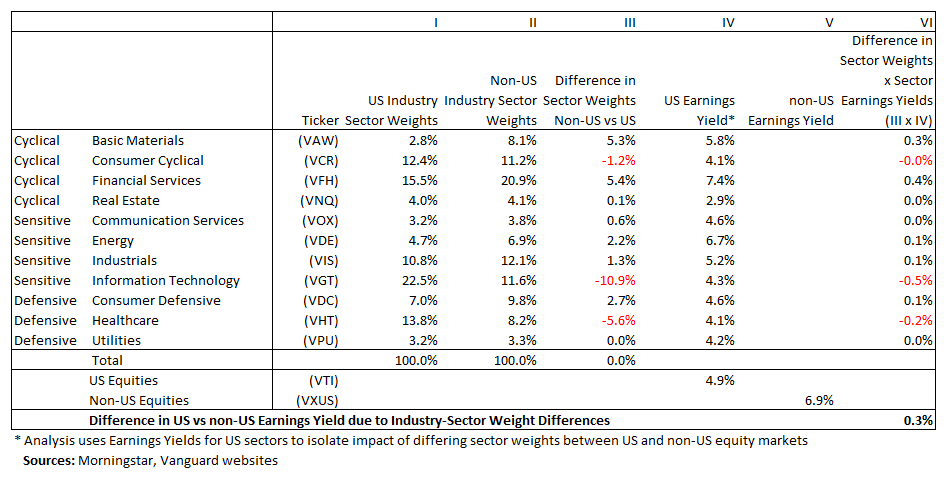

In a recent conversation we had with Seeking Alpha founder David Jackson, he posed a good question: to what extent could the difference in Earnings Yield between US and non-US equities be explained by US market-cap indices being more heavily weighted towards technology companies with high growth potential, while non-US markets lean towards lower-growth natural resource and financial companies? And if sector differences do explain much of the differential Earnings Yield, might we conclude that non-US equities may not in fact offer substantially higher long-term expected returns? 4

The table below addresses this question. Indeed, the US stock market has a 10.9% heavier weight than the non-US stock market in Information Technology companies, trading at a PE of 23.4x, counter-balanced by a roughly 11% lower weight in Basic Materials and Financial Services, trading at a significantly lower PE of about 15x. However, the differences in weights and PEs aren’t enough to explain much of the total difference in Earnings Yields between the broad US and non-US markets. We arrive at this conclusion by applying US industry-sector Earnings Yields to both US and non-US sector weights, and finding the difference in sector weights only accounts for 0.3% of the 2% difference in Earnings Yields between the broad US and non-US equity markets, as shown in bold in the table below.

Of course, it’s possible that a deeper dive into the growth prospects of each US and non-US sector might explain more of the difference in Earnings Yields. But, given that sector-makeup differences don’t seem to materially drive total-market Earnings Yield differences, perhaps it’s more likely that the higher valuation of the US equity market is a consequence of factors such as the much faster pace of US stock buybacks as well as the well-documented powerful home-bias of US investors. Long-suffering investors in non-US equities may well be in for still more suffering, but at least they should be comforted that the higher Earnings Yield of non-US equities is not a mirage that disappears when looked at through the lens of industry-sector weights.

- This not is not an offer or solicitation to invest, nor should this be construed in any way as tax advice. Past returns are not indicative of future performance.

- Earnings growth measured in earnings per index unit.

- Earnings-Yield is calculated as 1/PE. PE data from Vanguard.com for VTI and VXUS ETFs.

- Based on a view that Cyclically-Adjusted Earnings Yield is a good indicator of long-term expected real returns.

Previous

Previous