October 23, 2024

Featured Insights

Victor Meets the Bogleheads

By Victor Haghani, James White and Jerry Bell 1

Estimated reading time: 6 min.

“Bogleheads” are DIY investors who are passionate about index investing. They gather each year to share ideas about sensible investing, and to celebrate the life and contributions of John Bogle, the founder of Vanguard and arguably the person who has done more than anyone to improve investor welfare. Victor was very pleased to attend their recent annual conference in Minneapolis, and do a Q&A session with Morningstar’s Christine Benz. There were also about a dozen authors of excellent personal finance books and blogs who gave presentations, including Christine Benz, Rick Ferri, William Bernstein, Allan Roth, Mike Piper, Jackie Cummings Koski, Karsten Jeske and Sarah-Catherine Gutierrez. Victor thoroughly enjoyed the experience, and hopes he’ll be invited back to next year’s conference in Austin!

We agree 100% with almost everything discussed over the course of the three-day conference. However, one area where we noticed our opinions diverge from the Boglehead consensus view was on asset allocation. At Elm, one of our core beliefs is that optimal asset allocation should depend on the expected return and the riskiness of the assets being invested in, and on the individual’s degree of risk aversion. Expected returns and risk change over time, and therefore, so too should one’s asset allocation.2 We call our particular approach – which uses low-cost, broad coverage index ETFs to build client portfolios – Dynamic Index Investing®.

The consensus among Bogleheads – and among the vast majority of respected personal finance authors such as Charlie Ellis, Burton Malkiel, David Swensen and John Bogle – is that static asset allocation is the better approach.3 They believe that an investor should choose the percentage of their savings that they want to have in equities and then stick to that percentage through time.4 As John Bogle wrote in The Little Book of Common Sense Investing, “In general, investors should not engage in tactical allocation [varying the stock/bond ratio as market conditions change].” We respect these views, and know they have merit in many circumstances.

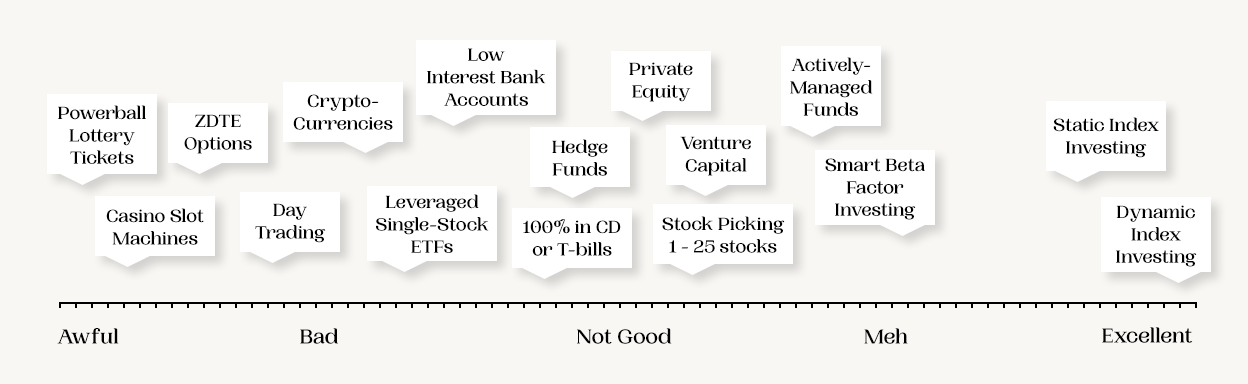

In this note, we want to explore the conditions under which the Bogleheads and like-minded investors are justified in following the static asset allocation approach – but before we dive into the details of this analysis, we want to say up front that on the broad spectrum of investment options ranging from utter folly to reasoned prudence (illustrated in the diagram below), both static and dynamic index investing are nearly on top of each other way over on the far right, sensible end of the continuum. We’re nearly as fond of Bogleheads-style static asset allocation as we are of Elm’s Dynamic Index Investing®, and in fact we do offer our clients a static index investing option if desired. So in this note, we’re really focusing a powerful magnifying glass at a very small strip of the investing spectrum.

The spectrum of investing styles for individual investors

The case for dynamic asset allocation

The theoretical case for dynamic asset allocation dates back to 1969 research by MIT economists Paul Samuelson and his student Robert Merton. One thing that came out of their research is a rule of thumb, known as the Merton share, which gives the optimal fraction of wealth (κ) that an investor should allocate to the stock market.5 The formula below has three inputs: the expected return of stocks over safe assets (μ), the riskiness of stocks (σ), and the investor’s individual degree of risk aversion (γ).

The Merton share

\[\kappa = \frac{\mu}{\gamma\sigma^2}\]The fraction of wealth to invest in equities would be constant if changes in the expected risk premium were always balanced by changes of the same proportion in risk (measured as variance). Historically, the stock market’s expected risk premium and risk have tended to move in the same direction, but not in such a precise way as to keep the optimal allocation to equities constant. In fact, they sometimes move in opposite directions, and those are the times the Merton share calls for large changes in asset allocation.

Of course, any asset allocation – dynamic or static – needs estimates for the expected return and risk of major asset classes. We’ve written frequently (here, here, and here) about why we think reasonable estimates do exist and how we come up with them – and, if you don’t want to do it yourself, there are many sources online you can use. A web search for “capital market assumptions” of Vanguard, Blackrock, JP Morgan, or most other investment management firms will provide long-term expected return and risk estimates for major stock and bond markets. We’ve found that estimates from these different sources are usually clustered together, so it shouldn’t matter too much which one you choose, although you may want to average several together – or you can just use the ones we provide on our Elm Wealth website.

We have written about the Merton share and its applications in our book, The Missing Billionaires: A Guide to Better Financial Decisions. In Chapters 2 and 3, we discuss its theoretical underpinnings; in Chapter 5, we present long-term historical simulations suggesting that dynamic asset allocation, using US equities and US treasury bonds, generated a compound return 2.5% above a static asset allocation with similar risk. We believe that future excess returns will be lower. Over a long horizon, we’d suggest 1.5% as the expected pretax extra return from a dynamic approach, and around 1% on an after-tax basis, both with less risk than a static approach.

The case for static asset allocation

Now let’s make the case for static asset allocation. We’ll lay out the circumstances and beliefs about markets under which keeping your asset allocation constant is the better choice.

1) You’re a DIY investor whose cost of time is high relative to capital deployed

Changing your asset allocation in response to varying market conditions is time-consuming, and doing it tax-efficiently is doubly so. It’s certainly more challenging than keeping your asset allocation constant over time, and some DIY investors may simply not have the wherewithal to implement a dynamic approach.

If you’re a committed DIY investor, you may find the static approach more attractive if you value your time higher than your expected excess risk-adjusted return from a dynamic approach. You’ll have to put in extra hours to follow a dynamic approach, collecting and processing expected return and risk data and deciding on and executing trades. Depending on your skill level and how you value your marginal leisure time, we could see reasonably deciding in favor of static asset allocation for portfolios up to around $250,000, even if you completely agree with our views around dynamic allocation.6

2) If you expect the stock market risk premium and risk to stay in a narrow range

Even if the cost to you of dynamically managing your asset allocation is low, either because you have a lot of wealth or you’re willing to outsource to a low-cost manager, a static weight portfolio might be the better choice if you believe that the equity risk premium and risk are likely to fluctuate in a narrow range. While that has not been the case in the past and isn’t what we expect, it’s not a completely unsupportable view. If expected risk premium and risk are relatively stable, and if they tend to move together when they do change, then you won’t be giving up very much by opting for a static asset allocation. Furthermore, if you expect to be adding to your investment portfolio over time, you may reasonably expect that you’ll sometimes be buying equities when they’re more attractive and sometimes when they’re less attractive, and so this can have a stabilizing effect as well. Of course, it is still important to set your equity allocation in line with the average risk premium and riskiness level that you expect, and your personal level of risk-aversion.7

3) Your “optimal” allocation to equities is more than 100%, but you decide against leverage

A static asset allocation can make sense when your human capital is stable and large relative to your financial capital. You are likely to conclude that your optimal asset allocation is to hold a leveraged position in stocks over a broad range for the equity risk premium and risk. However, if your cost of leverage is significantly above the risk-free rate, and/or you cannot continuously rebalance your portfolio to keep this leverage constant, then you may reasonably choose to avoid leverage. In this case, you’d be right to follow a static asset allocation holding close to 100% in equities.

A few arguments in favor of static asset allocation that we don’t agree with

1) Dynamic asset allocation is market timing

We sometimes hear that dynamic asset allocation is bad because it is a form of “market timing” and market timing is bad. But what is market timing? We asked ChatGPT “what is market timing?” and here’s what we got:

Market timing is an investment strategy that involves making buying or selling decisions of financial assets, typically stocks, based on attempts to predict future market price movements… it frequently involves making short-term trading decisions based on expected near-term price fluctuations.

Defined like that, we’re not fans of market timing either – but we maintain that Dynamic Index Investing® is not market timing as defined above. It is important to recognize that this style of dynamic asset allocation – driven by changes in expected risk premia and riskiness – does not rely on any market inefficiency. It just relies on changes in the supply and demand of capital over time.

In contrast, stock picking or factor investing – such as overweighting exposure to small cap stocks, value stocks, etc. – are approaches which do primarily rely on market inefficiency for investors to earn extra returns above and beyond what’s needed to offset the higher costs and risks involved in such strategies. All that extra return can only come from other investors who are taking the opposite active exposures. For such investing to make sense, you need to believe that you are profiting from market inefficiencies arising from the mistakes or preferences of the investors on the other side of your concentrated bets.

2) There aren’t good risk and return estimates

We often hear people say that our Dynamic Index Investing® approach doesn’t make sense because it is not possible to estimate the expected return and riskiness of stock markets. As we explained earlier in this note, we strongly believe that it is possible to reasonably make those estimates, and that they’re readily available online from many large investment management firms and our Elm Wealth website.

Furthermore, the argument that it’s not possible to estimate return and risk does not specifically favor static asset allocation because you still need those estimates in order to arrive at the weights of your static asset allocation. Indeed, in the true absence of any estimates for expected returns and risk, how is it possible to make investment decisions at all?

3) Or, it’s best to use historical returns, and they don’t change much

We suspect that, in many cases where an investor’s estimated returns and risk are quite constant over time, what’s implicitly happening is that those estimates are primarily being anchored to very long-term historical returns. Long-term historical returns are pretty constant over time, and so an asset allocation using them as inputs will be pretty static too. However, we caution against estimating the prospective return of the stock market based on historical returns.

To see why, consider using the historical return of a 30-year treasury bond to measure its expected return. Imagine that five years ago, it was trading at a 10% yield to maturity. Over the next five years, its yield declined by half, to 5%. The historical return on this bond will look fantastic at 20% per annum – but it won’t provide any clue that the forward-looking expected return from this bond, if held to maturity, is actually only 5%, not 20%.

Broad equity markets are obviously not completely bond-like, but they’re more similar to bonds than one might think. Earnings yield provides a decent predictor of future long-term returns because corporate earnings look somewhat bond-like when viewed across an entire large economy. Accordingly, you can view the earnings you’re getting divided by the price you’re paying as a good (though imperfect) estimate for the real return you should expect. In contrast, short-term or even long-term history just doesn’t provide the forward-looking information we need.

4) Dynamic asset allocation isn’t tax efficient

Dynamic asset allocation is indeed less tax-efficient than static asset allocation, which in turn is less tax-efficient than buy-and-hold.8 This is not an issue for investors whose wealth is primarily in non-taxable accounts like 401ks and IRAs. For taxable accounts, the tax inefficiency of the higher volume of trading in a dynamic approach can be mitigated through tax-loss harvesting and tax-aware rebalancing.

Conclusion

Despite the intuitively appealing nature of dynamic asset allocation, for many DIY investors, static asset allocation can be a better choice. Simplicity, comfort and ease of implementation are really important features of an investment strategy, and a static asset allocation scores high in those dimensions. While we believe that dynamic asset allocation is theoretically optimal, it is important to follow an investment approach that you are sufficiently comfortable with to stick with over long periods of time and different market conditions.

While static asset allocation has fewer moving parts and might seem easier than the dynamic approach, we have observed that a static asset allocation is more difficult to stick with over time and through changing market environments. We know very few investors who have maintained their chosen static asset allocation for more than several years before they read some news that makes them uncomfortable with their level of exposure, and they move to a new “static” allocation.

For us personally, dynamic asset allocation is more stress-free because it is both intuitively appealing and theoretically sound. Importantly, it allows us to own more equities over time and worry less. Whichever approach you choose, as long as you’re like the Bogleheads Victor met in Minneapolis who build their portfolios with low-cost, broad index funds while keeping an eye on taxes and other fees, you’ll be at the very best end of the spectrum of investment choices.

An example of when dynamic asset allocation worked well

Our choice of this example is for illustrative purposes only, and not to suggest that dynamic asset allocation will always or usually outperform a static asset allocation approach. As we’ve discussed in the body of this note, we recognize that dynamic asset allocation may not be appropriate for many investors. There are many 10-year periods over which dynamic asset allocation would have resulted in a return below and/or a risk above that of a static asset allocation. However, we believe that changing your asset allocation over time as the expected excess return and risk of stocks change, is a more logical approach than keeping your allocation constant through time.

At the end of the year 2000, the cyclically-adjusted earnings yield of US equities was 2.9% and US inflation protected bonds (TIPS) had a real yield of 3.75%. At the end of 2010, the earnings yield of US equities was 6% and TIPS offered a 1% real yield. If you believe, as we do, that the earnings yield of the equity market is a decent estimate of its long-term real return, then you would not have wanted the same asset allocation at the end of 2010 as you had at the end of 2000. And you would have been justified in owning less equities and more TIPS in 2000, and more equities and less TIPS in 2010. Over the first decade of this century, US equities under-performed 10-year maturity TIPS by over 4% pa, while in the second decade, it was the other way around, with equities outperforming TIPS by 10% pa.

An investor who kept 60% in US stocks and 40% in bonds over the two decades enjoyed a compound return of 7.1%, while an investor who was 30%/70% in stocks/bonds for the first ten years, and then 90%/10% in stocks/bonds for the next ten years – for an average exposure of 60/40 – would have earned a compound return of 9.2%, 2.1% higher, with roughly the same risk. The dynamic asset allocator’s realized Sharpe ratio would have been 27% higher than the Sharpe ratio of the 60/40 static weight investor.

Appendix: How some respected personal finance books line up on the static versus dynamic asset allocation debate

| Books advocating static asset allocation |

Books advocating dynamic asset allocation |

| The Little Book of Common Sense Investing by John Bogle | Dynamic Asset Allocation by James Picerno |

| Unconventional Success by David Swensen | Strategic Asset Allocation by John Campbell and Luis Viceira |

| The Four Pillars of Investing by William Bernstein | Continuous-Time Finance by Robert Merton |

| If You Can by William Bernstein | Expected Return by Antti Ilmanen |

| The Little Book of Safe Money by Jason Zweig | The Missing Billionaires by Victor Haghani and James White |

| Morningstar’s 30-Minute Money Solutions by Christine Benz | |

| All About Asset Allocation by Rick Ferri | |

| A Random Walk Down Wall Street by Burton Malkiel | |

| The Elements of Investing by Charles Ellis and Burton Malkiel | |

| Winning the Loser’s Game by Charles Ellis | |

| Stocks for the Long Run by Jeremy Seigel | |

| How to Think About Money by Jonathan Clements | |

| Enrich Your Future by Larry Swedroe | |

| Lifecycle Investing by Barry Nalebuff and Ian Ayres | |

| Risk Less and Prosper by Rachelle Taqqu and Zvi Bodie | |

| Personal Finance for Dummies by Eric Tyson | |

| The Only Investment Guide You’ll Ever Need by Andrew Tobias | |

| The Index Card by Helaine Olen and Harold Pollack | |

| The Intelligent Investor by Benjamin Graham | |

| Global Asset Allocation by Mr Meb Faber |

Further Reading and References

- Asness, C, Ilmanen, A., and Maloney, T. (2017) “Market Timing: Sin a Little.” Journal of Investment Management.

- Campbell, J. and Shiller, R. (1988). “Stock Prices, Earnings and Expected Dividends.” Journal of Finance.

- Faber, M. (2013). A Quantitative Approach to Tactical Asset Allocation. The Journal of Wealth Management and SSRN.

- Haghani and White. (2024). “Introducing P-CAPE: Incorporating the Dividend Payout Ratio Improves Our Favorite Estimator of Stock Market Returns.”Elm Wealth.

- Haghani and White (2022). “Man Doth Not Invest by Earnings Yield Alone: A Fresh Look at Earnings Yield and Dynamic Asset Allocation.” Elm Wealth.

- Haghani and White. (2018). “What Gamblers Can Teach the Buy and Hold Crowd.” Elm Wealth.

- Haghani and White. (2023). The Missing Billionaires: A Guide to Better Financial Decisions. Wiley.

- “Historic CAPE Ratio by country.” (2024). Barclays.

- This not is not an offer or solicitation to invest. Past returns are not indicative of future performance. We thank William Bernstein, Rich Dewey, Rick Ferri, Larry Hilibrand, Antti Ilmanen, Vladimir Ragulin and Jeffrey Rosenbluth for their helpful comments and suggestions. As always, we relied on and appreciate the contributions of our colleagues Jerry Bell and Steven in all aspects of researching and producing this article.

- Of course, for nearly all assets, neither expected returns nor expected risk can be known precisely – but, for many core asset classes such as broad-market equities, there are reasonable metrics which are robust, well-known, and widely agreed on.

- See appendix for a fuller list of select books on personal finance from both sides of the debate.

- Maintaining fixed portfolio weights requires rebalancing trades, which involve buying underperforming asset classes and selling those that have done best.

- Primarily assuming the stock market follows geometric Brownian motion, the safe asset is risk-free, continuous trading is possible, and the investor exhibits CRRA utility risk aversion and wishes to maximize his expected utility.

- Assuming you value your time at $100 per hour after-tax, you estimate you’ll need to spend an extra two hours per month for the dynamic approach, and you expect the dynamic approach to deliver 1% extra after-tax returns.

- For the average risk level, you’ll want to use your average expected variance of returns, since that is the denominator of the Merton share.

- I.e. not rebalancing to maintain static weights over time.

Previous

Previous