March 11, 2019

Taxes

When it Pays to Pay Capital Gains

By Victor Haghani, Lawrence Hilibrand and James White 1

US taxable investors know the importance of managing their investments tax-efficiently. A standard approach to the management of capital gains and losses is to defer realization of gains for as long as possible, while aggressively realizing losses,2 particularly short-term losses, a strategy often referred to as “tax-loss harvesting”. However, upon closer examination, this can be significantly improved upon for investors who tend to have a steady stream of short-term capital gains – and in a seemingly counter-intuitive way.

Instead of trying to defer realizing a long-term capital gain as long as possible, it can make sense to realize the gain shortly after one year has passed since purchase and the gain becomes subject to the preferential long-term tax rate. If the asset is sold and repurchased, the basis in the asset and the “basis clock” are both reset, thereby creating the option to realize a valuable short-term capital loss if the asset falls in the year ahead.

This sounds good, but does it actually add net expected value? We need to compare the expected value of a short-term loss “option” to the expected cost of giving up deferral of a long-term capital gain.3 We value a realized short-term loss at 17% of the loss amount, which is the difference in Federal tax rates for short-term versus long-term capital gains. The value of deferring a capital gain is primarily a function of the expected horizon of the deferral – all else equal a longer deferral period has greater value.4

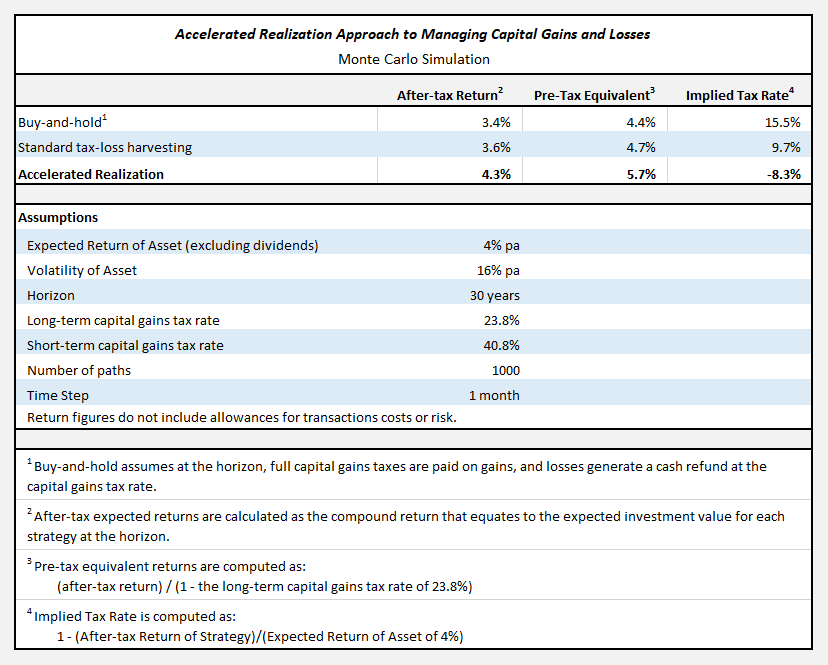

We set up a Monte Carlo simulation to estimate the expected value of the accelerated realization approach compared to both a buy-and-hold approach and to the standard tax-loss harvesting approach. The results and assumptions of the simulation are laid out in the table below.

What we find is that an investor following the accelerated realization approach would have an expected pre-tax equivalent return about 1.3% pa higher than a simple buy-and-hold approach,5 and 1% higher than the standard tax-loss harvesting approach. The results appear quite robust. For example, taking a shorter horizon of ten years, the difference between the approaches changes by only about 0.15% pa, with the buy-and-hold looking a bit worse and the standard tax-loss harvesting looking a bit better (both compared to the accelerated realization strategy). Higher tax rates, maintaining the same difference between the short-term and long-term rates, don’t have much impact on the difference in expected returns either.6

The accelerated realization approach may be more valuable for some investors and portfolio strategies than for others. It will be especially effective for those who regularly incur short-term capital gains and highly value short-term capital losses,7 who have relatively static or slow-moving portfolio allocations,8 and who can trade their portfolios with low transaction costs.

The approach we describe keeps the portfolio more “evergreen” from a tax perspective, in that it slows the build-up of large long-term gains which can then unduly bias allocation decisions. While there will be variability in the tax advantage an investor experiences depending on the path the asset takes, it is an added bonus that the realized tax benefit will tend to be higher the worse the asset performs and the more volatility the asset experiences. That’s to say, you get some extra tax benefit in environments which are otherwise not so great. So it looks like in certain situations, paying your taxes early and often might be a surprisingly tax-efficient way to go.

If you’d like to learn more about our approach to delivering tax-efficient returns, or more about our investment approach in general, you can request more info on our home page here or schedule a call here with James, our CEO.

Further Reading and References:

- Constantinides, George, “Optimal Stock Trading with Personal Taxes: Implications for Prices and the Abnormal January Returns” NBER Working Paper No. 1176, (1983)

- Dammon, Robert, Dunn and Spatt, Kenneth, “A Reexamination of the Value of Tax Options”, The Review of Financial Studies, Volume 2, Issue 3, (July 1989), Pages 341–372.

- Andrew Kalotay has written extensively on this topic. You can find his research on Kalotay.com.

This idea was described by Joseph Stiglitz as a strategy of “immediate realization” in his paper, “Some Aspects of the Taxation of Capital Gains”. Journal of Public Economics, pp 2, 5-7, (1983)

- This not is not an offer or solicitation to invest, nor should this be construed in any way as tax advice. Past returns are not indicative of future performance.

Thank you to our friend and accountant David Untracht for his helpful comments. Of course, any errors are our own.

- Subject to wash-sale rules.

- We also need to take account of transaction-costs and the risk associated with complying with the wash-sale rule when realizing a loss.

- The value of deferral is also greater the higher the effective tax rate and the higher the expected rate of return on the asset. Deferral is also more valuable if the investor expects to avoid capital gains tax completely by donating or bequesting the appreciated asset in the future. Expected changes in tax rates and tax rules also impacts the value, or potential cost, of deferring capital gains.

- A simple back-of-the-envelope estimate for this difference, if we could only trade once at the end of every year and using the other assumptions in the table, would value the option to realize a short-term loss at the end of the year as 4.7% (the value of a one-year at-the-money put option with 16% volatility and a 4% risk-free rate) times the value of converting a short-term gain into a long-term gain of 17%, which gives a value of 0.80% after-tax.

The value of a 30-year deferral is the difference between the return of investing for 30 years at 4% and paying tax at the end versus paying the tax every year, which is 0.33% after-tax. So, the net benefit is 0.47% (0.80% – 0.33% ) after-tax, or a pre-tax equivalent of 0.62% pa. We find a much higher benefit of 1.3% in our simulation primarily because we can trade once every month, which is of significant incremental value.

- Choosing to not realize long-term gains if they were particularly high improved results, but only marginally.

- For investors who do not expect to have short-term capital gains every year, the incremental value of this accelerated realization approach will be eroded, or even erased.

For example, if we assume the investor has only a 50% chance of having short-term gains in a given year, and will only find out whether he has gains after the year ends, the extra expected return from accelerated realization compared to standard tax-loss harvesting drops from 1% to about 0.25% pa (assuming that if the investor doesn’t have short-term gains in a particular year, short-term losses can still be offset against long-term gains). Also, the value will be impacted negatively for investors who are more likely to have short-term capital gains in years when the stock market has risen.

- Not having any tax-lots with a long-term basis can be inconvenient for dynamic strategies which may need to sell and would like to avoid realizing short-term gains.

Previous

Previous