September 30, 2016

Investing 101

What’s all the hoopla? Passive indexers are still a rare breed

We’ve just passed the 40th anniversary of the first index fund (Vanguard’s, naturally) and everyone’s talking about how passive indexing is taking over the world. That may be a good or bad thing, depending on your perspective, but a more fundamental question is whether it’s actually a fair description of what’s happening? We think not.

Index funds are the offspring of Modern Portfolio Theory (MPT), which tells us that the equity portfolio that provides the most attractive return-to-risk ratio is the Market Portfolio, a market cap weighted index of all equities, everywhere. The theory says we should only invest in equities through this Market Portfolio: any other portfolio choice is simply sub-optimal.

The major index fund providers offer funds that give investors direct and simple access to this Market Portfolio, such as Vanguard’s aptly named Total World Stock ETF (ticker VT). If investors were truly indexing as directed by MPT, wouldn’t we expect that these index funds, designed to deliver the Market Portfolio straight up, would attract all, or at least the lion’s share, of the assets of index investors?

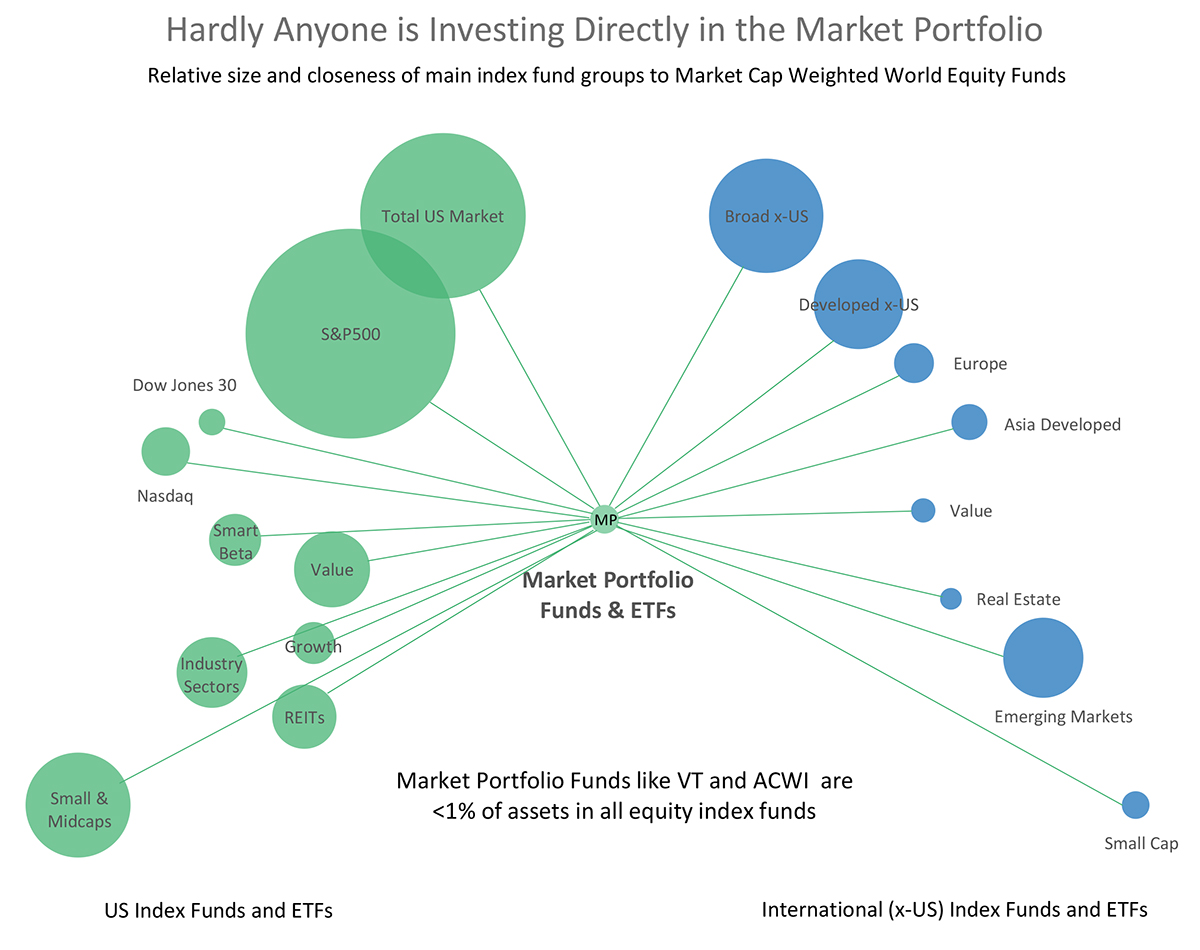

They don’t. The chart below shows just how tiny these Market Portfolio funds are, when compared to their component building blocks. In fact, they make up well under 1% of the roughly $4tr equity index fund and ETF market. VT, the biggest of these Market Portfolio funds, barely even scrapes into the top 100 largest ETFs in the world.

Why are investors doing this? We can’t know what motivates each investor, but since at Elm we are also not investing in the straight-up version of the Market Portfolio, maybe our thinking will be representative of others. In short, while we believe that MPT is a great start for building a portfolio, there are a number of assumptions in the theory that are not realistic and lead us to go beyond a market cap weighted portfolio in constructing our Baseline portfolio, such as public equity markets being incomplete, inefficient, unrepresentative and driven by more than just the single risk factor of Beta. In addition, there are tax and cost benefits in going beyond a single holding of a Market Portfolio fund. We’ve described these in more detail in the box below.1

Conclusion: most index investors are active index investors.

While it’s undeniable that passive index products have witnessed great success, and investing has become more democratized as a result, we think it’s a stretch to say that passive indexing is taking over the world. Instead, investors are moving away from traditional, higher cost forms of active management and building more complex, granular and nuanced portfolios themselves using index products. At Elm, this is exactly our approach, which we call Active Index Investing®. If you’ve decided you want to put part of your savings into index funds, but feel you should be able to do better than putting it all into one global market cap weighted fund, then please take a closer look at what we do.

You can read more about our approach here, or feel free to request a callback.

Why index investors like us are not investing in Market Portfolio funds

Public equity market is incomplete.

Examples include the under-representation of large asset classes, such as real estate or emerging market equities, the fact that different regions have vastly different proportions of private relative to public companies, and, certain markets may not be freely accessible to international investors like mainland China.

Markets not perfectly efficient.

Market cap weights have a tendency to overweight over-valued markets and underweight under-valued markets. Remember the Nikkei in 1989?

More than just Beta driving returns.

Most investors believe there are other sources of risk premia such as small caps or value stocks.

Home bias.

Investing in one’s home market is more attractive than investing in foreign markets which carry currency risk, may be more costly to hold (e.g. withholding tax inefficiencies) and tend to be less relevant to one’s future consumption.2 An extreme case is Warren Buffett’s recommendation for non-professional investors to hold only the S&P500 for their risk asset allocation.3 Tellingly, Vanguard calls its most popular index fund that invests in only US equities the “Total Stock Market Index Fund,” which is probably not unrelated to why the US national baseball championship is called the “World Series.”

Tax benefits.

Having multiple holdings may allow a portfolio to be managed more tax-efficiently. For example, it provides more opportunities to realize short-term capital losses for US investors.

Cost savings.

These Market Portfolio funds aren’t the most cost effective. Vanguard’s VT is 14bp and iShares ACWI is 33bp. An investor would save 6 to 25 bps in fees by combining a US ETF, VTI @ 5bps, with an x-US developed market ETF, VEA @ 9bps, and an emerging market one, VWO @ 15bps.

- Besides the reasons that we at Elm don’t invest in the cap weighted Market Portfolio as listed in the sidebar, there are other explanations for why index investors are doing likewise. For example, investors may make a sector by sector decision to go passive vs active. Also, many investors are susceptible to line item bias, or naïve diversification, which is the feeling that the more lines they see on their brokerage account, the more diversified they feel, even if those products are almost identical.

Studies by Professor Richard Thaler and others have found that investors like to spread their investments over many options on the menu, even when some investments are overlapping or even dominated. For example, investors will invest in two S&P500 index funds with different fees. Benartzi and Thaler, Naive Diversification Strategies in Defined Contribution Saving Plans, (2001) and separately, Fisch and Wilkinson-Ryan, UPenn, Why Do Retail Investors Make Costly Mistakes? An Experiment on Mutual Fund Choice (2014). Another reason may be investors may only go passive in certain geographies or sectors where they feel the market is completely efficient, and seek alpha in more niche areas.

- Kim Stockton of Vanguard, 2015:

“…the US equity market cap is about 49% of the global equity market, yet US investors have 71% of their assets invested domestically. The U.K. equity market is roughly 8% of the global equity market, yet U.K. investors have about 50% of their assets invested at home. And in Australia, resident investors have a 70% overweight to domestic equities relative to their 3.5% share of the market.” - While it is true that S&P500 companies derive close to 50% of their sales from outside the US, limiting one’s investment to the biggest 500 US companies leaves one pretty far from the Market Portfolio, as it covers less than 50% of companies on a global basis and 80% of total US market cap.

Previous

Previous