March 14, 2025

Featured Insights

All Quiet on the Stock Market Front?

By Victor Haghani and James White1

Since the election of Donald Trump, the global stock market as a whole has been pretty tranquil, dropping in value by 2.5%. Daily volatility has clocked in at an annualized rate of around 13%, well below its long-term average. This placid surface view masks some pretty meaningful underlying turbulence, as investors have been reassessing their views on the prospects and valuation of broad asset classes. Given the typically US-centric coverage of the financial press, we thought it worthwhile to highlight the dramatic shifts in international relationships we’ve seen since election day in early November.

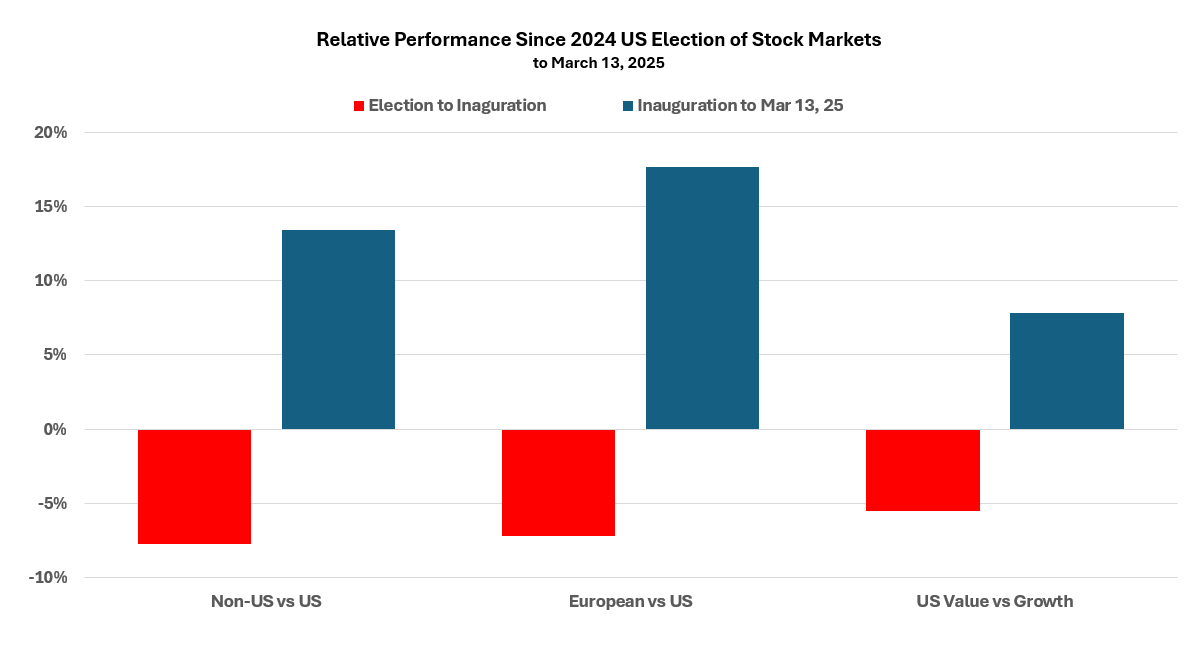

In the 10 weeks from election to inauguration, US stocks outperformed non-US stocks by 8%.2 Then, in the seven weeks from inauguration to yesterday’s close, non-US stocks have recouped all that underperformance and more, outperforming US stocks by 13.5% – an apt example of the “buy the rumor, sell the fact” adage.3 Even more remarkable, since inauguration, non-US equities have done better than the US stock market on 31 out of 37 days. These relative performances in either direction are unusual, and the largest we’ve seen in the more than 13 years that Elm Wealth has been in business.

Over this time, much press has been devoted to the fluctuations in the fortunes of growth versus value stocks in the US market. From election to inauguration, growth stocks outperformed value stocks by 5.5%, and then underperformed by 8% from inauguration to present. While these are large moves, they’re not the epicenter of recent dislocations, which we think is found in US versus European equities. European equities underperformed by 7% from election to inauguration, and then made 7% seem puny as they surged ahead of US stocks by 17.5% since inauguration.

Over the past 20 years, the correlation in daily returns between US and European stock markets has run at 0.86, while in the past four months that correlation has dropped in half to 0.43.4 Perhaps one message from the time since Trump’s election is that we should expect and prepare for relationships and correlations to change frequently and dramatically. This is of particular concern for investors who use leverage and/or concentration in the hope of generating above-market returns.

We’re not believers in extrapolating past performance– whether recent or longer term – into the future. Rather, we like to estimate long-term expected returns based on expected cash-flows, as we explain in our quarterly capital market assumptions reports. As you know from our research and our offerings, such as our customizable SMAs and our recently launched ETF, we seek out as much diversification as we can get, subject to keeping fees and costs low and tax-efficiency high, while updating our asset allocation in line with long-term expected returns and risk.

Being diversified means you’ll always do worse than the best performing asset you could have owned, but it also means you’ll always do better than the worst performing one. If everything moves together, there’s not much benefit in diversification. But if the past few months are any guide, it seems likely there will continue to be significant benefits from a high degree of diversification.

- This is not an offer or solicitation to invest, nor are we tax experts and nothing herein should be construed as tax advice. Past returns are not indicative of future performance.

- We are using the total return of Vanguard’s ETFs, VXUS, VTI, VGK, VTV and VUG for all the return analysis in this note.

- Some observers feel that’s an apt description of what we’ve seen with the prices of cryptocurrencies like Bitcoin, which was up about 50% from election to inauguration, and then down about 20% from inauguration to present.

- One way of thinking about these correlations is that if you flipped two fair coins 100 times and if the correlation between them were 0.86, you’d expect them to land the same way 93 out of 100 times. With 0.43 correlation, you’d expect them to land the same way 71 out of 100 times.

Previous

Previous