November 5, 2015

How Elm Works

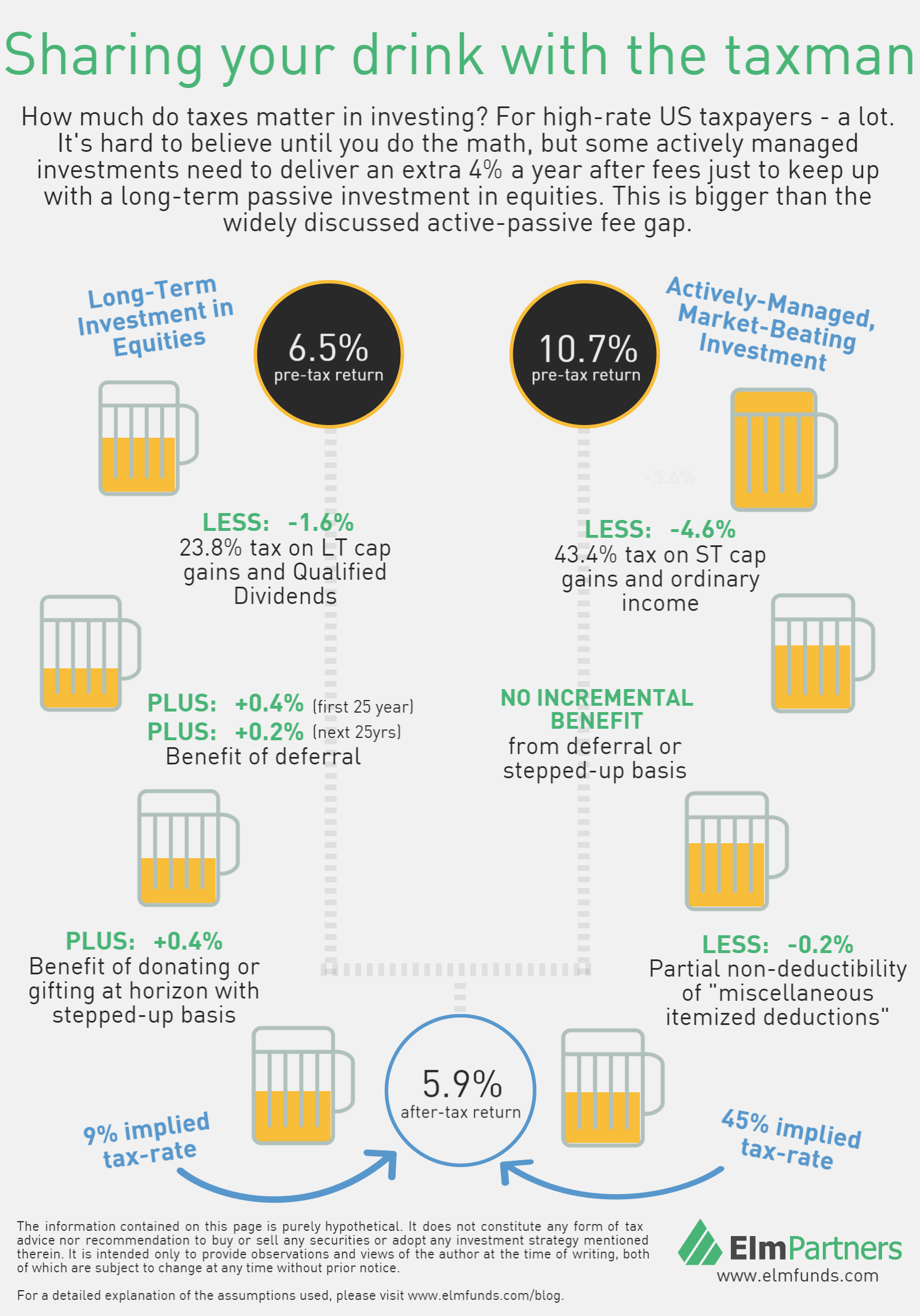

Infographic: How much do taxes matter in investing?

The passive vs active investing debate usually centers on low vs high fees and the plausibility of superior investment performance. For many taxable investors, taxes can matter more than either of those, as there can be a huge difference in the slice of returns you pay in taxes between passive and active investment styles. We put together an infographic to illustrate this difference in a practical example for a US high rate taxpayer.

Assumptions and discussion of other cases:

Tax is a complex topic.1 Each of us has a different tax situation, and even within a family, different pools of savings are taxed differently. I based this note on the case of a high income US taxable investor, resident in a no-income-tax state (e.g. Texas, Florida, Wyoming). I assume (perhaps optimistically) today’s tax rates, and tax rules, stay constant in the future. Today’s federal tax rates are 39.6% for short-term capital gains and ordinary income, and 20% for long-term capital gains and Qualified Dividends. All investment income is subject to the 3.8% Affordable Health Care tax (aka Obama-care tax).2 There are a variety of limitations on deduction of investment related expenses in the tax code, which can make a big difference in after-tax returns. In the base case, I have assumed miscellaneous itemized deductions are only partially disallowed, but I also present the case of full non-deductibility of these expenses.

I’m comparing two fairly extreme cases, but they are not the most extreme I could have chosen. For example, for tax-payers subject to high state taxes the gap would be even greater.

Investment gurus such as Vanguard founder John Bogle and Yale endowment’s David Swenson counsel investors to put their focus on what they can control, and in addition to controlling fees, investors can have quite a lot of control over how their investments are taxed. This is a general note about the impact of taxes on investment returns, and is not specific to any strategy pursued by Elm Partners, although tax awareness is an integral part of our approach. Please feel free to get in touch with me if you’d like more detail or just a general discussion of the topic.

For the Passive Equity Investment, I use 6.5% as the long-term expected return of the global stock market, comprised of an expected real return of 4.5% and expected inflation of 2%. See this video for why 4.5%, but in summary I use 2.5% as the current global stock market dividend yield (it would be about 3% if adjusted for U.S. stock buyback activity) plus an expected real dividend growth rate of 2% (1.5% adjusted for buybacks). For simplicity, I assume all dividends are Qualified Dividends, although for a global equity portfolio this is currently not quite the case.3 I assume that the equity investor uses ETFs to pursue a buy-and-hold strategy, and that ETFs are sufficiently tax efficient that they will not throw off any capital gains (unlike investments in 40 Act mutual funds) even though the underlying indexes on which they are based do produce portfolio turnover (see this note for more on this tax benefit of investing in ETFs). If portfolio turnover were 5% per annum,4 the value of deferral would be lower by about 0.1% for a 25 year horizon, and the benefit of an extra 25 years would be about 0.1% lower too.

In the ultimate case of a long-term investment in equities that will be donated or bequeathed at the horizon, the after-tax rate of return is simply the starting dividend rate, after-tax, plus dividend growth, which given the above numbers is:

2.5% * (1 – 23.8%) + 4% = 5.9%

For the generic Actively Managed Investment, I chose a 10.7% pre-tax return so that it results in the same after-tax return of 5.9% enjoyed by the passive investment in equities. I assume the Actively Managed Investment return comes in the form of ordinary income or short-term capital gains. In practice, the tax characteristics of a given actively managed investment may be more attractive than this (e.g. having some component of qualified dividends, long-term capital gains or deferred capital gains), or less attractive (e.g. ones that throw off interest income together with capital losses which cannot be netted against the income5). It is worth bearing in mind that many, but not all, active alternative investment vehicles are aimed at institutional investors such as pension funds or endowments which do not pay tax, and hence they may not be managed with tax efficiency a priority. I assume miscellaneous itemized deductions of 2.5% each year (e.g. management fee of 2% plus administration, legal and audit expenses of 0.5%)6 In case you’re not familiar with the term “miscellaneous itemized deductions,” think of it as IRS code for “expenses that the tax rules try to prevent you from deducting from your income.” I assume that the tax circumstances of the investor are such that the deduction cannot be taken in full, but are limited by the 2% and 3% of adjusted gross income limitations on deductions and also the disallowance of deductions in the application of the 3.8% Obama-care tax7.

How a 10.7% pre-tax return turns into a 5.9% after-tax return is quite straightforward. First, tax the 10.7% return at the 43.4% tax rate, and then subtract the 6.0%8 of the 2.5% miscellaneous itemized deduction which is disallowed, so:

10.7% * (1 – 43.4%) – 6.0% * 2.5% = 5.9%

Other cases:

For the base case I used above, I assumed a partial but not total loss of miscellaneous itemized deductions. Many investors have miscellaneous itemized deductions that are less than 2% of adjusted gross income, which means that they are completely disallowed. In such a case, the pre-tax return of an Actively Managed Investment would need to be 12.4% rather than 10.7%, which is nearly double the pre-tax return of a tax-efficient long-term investment in equities:

12.4% * (1 – 43.4%) – 43.4% * 2.5% = 5.9%

Let’s take a look at how these numbers come out for an investor who lives in a state with a high (say 9%, which is close to the top rate in NY State) income tax.

For the long-term, passive equity investor, the marginal tax rate will be roughly:

20% + 3.8% + 9% = 32.8%

(assuming state tax on investment income

isn’t deductible against federal tax)

The after-tax return of a long-term equity investment with this tax rate, taking account of deferral and the benefit of stepped-up basis at the horizon, will be 5.7%, for an effective tax rate of 12%. With 25 years of deferral, but not stepped-up basis benefit, the after-tax return would be 4.9%.

For the Actively Managed Investment, I’ll assume that the investor has enough deductions so that the relevant federal tax rate is the 28% Alternative Minimum Tax (AMT). Note that in the AMT, all deductions (miscellaneous and other, except for charitable contributions) are disallowed. The tax rate here is:

28% + 3.8% + 9% = 40.8%

The return required to deliver the 5.7% after-tax return of long-term equities is 11.3%:

11.3% * (1 – 40.8%) – 40.8% * 2.5% = 5.7%

(a 50.0% effective tax rate)

What return does this active investment need to deliver before fees, assuming it’s an alternative investment with a 20% incentive fee on the return in excess of the 2.5% management and operational fees? The answer is 16.7%, roughly 2.5x the return of a passive long-term investment in equities:

(11.3% + 2.5%) / (1 – 20%) = 16.7%

Investors generally view equities as providing some protection against higher inflation. In our base case, we assumed 2% inflation, and found that Actively Managed Investments needed to return 4.2% more than equities (10.7% vs 6.5%) in order to deliver the same after-tax return. If we assumed inflation of 4%, and a long-term equity return of 8.5% (still a 4.5% real return), an Actively Managed Investment would need to earn 5.7% more than equities (14.2% vs 8.5%) in order to give the same after-tax return. In real terms, an investment in equities may well provide better protection against higher inflation.

I do not show the effects of investment volatility on these tax outcomes. For example, when you pay taxes on your returns in full every year, and then have a loss one year, the government generally doesn’t pay you “negative taxes” – you just have to carry that capital loss forward into the future and hope for better times ahead. If you’ve reached your investment horizon (e.g. you’re donating or gifting your wealth), then you don’t get any benefit of the capital loss. This can be a significant effect9. For example, in the case of an investment that has 15% annual volatility and delivers 6% a year annual return, this asymmetry in tax treatment can lead to a drain of about 0.4% a year over a 25-year horizon.

I have left for a future note a discussion of “tax loss harvesting,” which for some investors can be a significant extra benefit of tax-aware investing. I also do not take account of how different investment styles tend to be more or less tax efficient. See this 2012 paper by Israel and Moskowitz for a discussion of why value investing is not very tax efficient, while momentum investing is.

Please feel free to get in touch to discuss further, or to make this note better.

Other references:

- I’d like to thank my friend Larry Hilibrand (like me, not a tax expert), who has very patiently helped me to focus on and understand these issues. If you want expert advice on taxes, you should speak to my accountant, David Untracht – he’s terrific. Of course, any errors in this note are my own.

- This is a simplification. For example, some degree of investment related expenses are allowed as deductions in the computation of the affordable health care tax surcharge.

- Just under 90% of dividends in Vanguard’s global equity ETF, VT, were qualified in 2014.

- And average cost accounting were used instead of specific tax lot accounting.

- Such as may occur with a portfolio of high yield bonds that pay a high rate of interest but suffer occasional realized capital losses from defaults.

- For some investments, the amount of these itemized deductions can be well in excess of 2.5%, such as in private equity or VC vehicles that charge fees on committed, but undrawn capital, or that incur significant portfolio expenses in making their investments.

- I did not take account of the potential benefit that a high return/high tax investment might have in estate planning, for example in a case where a parent, through use of a trust, pays the tax on an investment while giving the return to a beneficiary (in addition to not being a tax expert, I am also not an estate expert).

- 6.0% = 2% of 43.4% + 3% of 43.4% + 3.8%

- There may also be more subtle convexity effects, beyond the scope of this short note, that become apparent in the presence of investment volatility.

Previous

Previous