The Problem

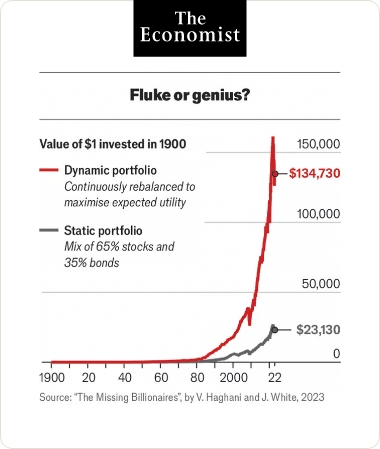

Markets change. Risk environments shift. Expected returns vary dramatically over time.

Investors know markets change, but Their portfolios don’t. This disconnect can destroy wealth over time.

Markets constantly present different risk and expected return opportunities as conditions evolve.

There’s a false choice in investing: either hold static allocations that ignore changing market conditions, or try to predict market movements. Both approaches can destroy wealth.

An Eyes-open Approach

to Index Investing

Dynamic

Index

Investing®

Portfolio building blocks of highly liquid, low-cost index ETFs

Rules-based framework to dynamically respond to the shifting attractiveness of major markets

Portfolio building blocks of highly liquid, low-cost index ETFs

Rules-based framework to dynamically respond to the shifting attractiveness of major markets

Combining the low costs and simplicity of passive index investing with the hands-on-the-wheel comfort, dynamism, and responsiveness of active management.

Unlike traditional static portfolios, our Dynamic Index Investing® approach intelligently adjusts your market exposure based on two crucial factors:

Expected Returns

We increase equity exposure when when we believe market opportunities are attractive and reduce it when they’re not.

Market Risk Levels

We adapt your portfolio to match market conditions in an effort to provide protection during turbulent times and greater participation during calmer periods.

1 measured relative to a safe asset

Neutral Allocation to Equities

TRY OUR ASSET ALLOCATION VIEWER

Want more Elm insight? Read our piece on Value and Momentum in Asset Allocation

A Practical Approach Backed by Research

See All ResearchFeatured In

Featured In

Featured In

Featured In

Featured In

Featured In

Featured In

Featured In

The Elm Difference

Rules-Based

Our systematic approach is designed to remove emotional bias from investing

Tax-Efficient

Automatic tax-loss harvesting and thoughtful portfolio management that considers tax implications

Cost-Conscious

Low-fee index funds as building blocks

Highly Liquid

Maintain ready access to your investments

Deeply Diversified

Broad exposure to global markets

Research-Driven

Regular market insights shared through our blog

How It Works

Elm clients hold Separately Managed Accounts personalized to their goals and preferences

75%

75%

Baseline Equity Allocation

Your preferred mix of stocks versus low-risk assets in normal market conditions

ELM

ELM ADJUSTED

MARKET-CAP

WEIGHTS

Geographic Distribution

Your desired balance between US and Non-US Equity. Neutral weight is 58% US / 42% Non-US

50%

50%

Dynamic Scaling

How actively your portfolio responds to changing market conditions

Account Structure

- Separately Managed Accounts at Fidelity, Schwab, and JPMorgan

- Assets stay with your own name with daily liquidity

- Start with cash or existing assets

Taxes

- Tax-Loss Harvesting included for all taxable accounts

- Comparably tax-efficient to a traditional static-weight portfolio

- Sector ETF strategies for additional Tax Loss Harvesting opportunities

Costs

- 0.12% Management Fee

- 0.05% Weighted-average underlying expense ratio of ETF holdings

- Commission-free trading at Fidelity and Schwab

*Elm's SMA program is designed primarily for US investors. Tax circumstances may make this option unsuitable for non-US investors. For non-US investors, please inquire about fund options for offshore investors. All fees and expense ratios as of 1/31/2025.

FAQs

We’ve put a great deal of effort into making each taxable SMA as tax-efficient for a US investor as possible.

In our core SMA product for taxable investors, we re-balance each investor’s portfolio approximately every week, and our systematic rebalance algorithm attempts to optimize between minimizing realized short-term taxable gains, maximizing realized short-term taxable losses, keeping the portfolio within certain bounds of our target risk allocations, and minimizing transaction costs. We also try to minimize realized long-term capital gains, but we place significantly less emphasis on this relative to the focus we put on short-term gains. Because many of the dozen-or-so core risk markets we invest in are related, and several instruments are generally available per market, we can often achieve a much better tax result for our investors than if we just naively re-balanced each market without thinking about taxes.

Despite the higher expected turnover of our dynamic approach compared to a static approach that re-balances back to fixed weights, there are several subtle but significant effects that, together, yield high expected tax efficiency. First, the momentum overlay is what generates most of the additional turnover compared to a static approach, and its nature is to generate frequent but small short-term capital losses punctuated by less frequent but large long-term capital gains. Second, our portfolio turnover generally takes the form of buying and selling a small ‘top’ slice of the portfolio, which typically has relatively low built-up gains or losses. Beneath this ‘top’ slice, there will tend to be a more static base layer of the portfolio that can hold a buildup of unrealized long-term capital gains.

By default, all taxable SMA investors benefit from automated tax-loss harvesting, and our system automatically works to prevent tax-adverse wash sales between groups of linked accounts. We also try to earn as much income as possible in the tax-preferred form of Qualified Dividends.

Please be aware that tax performance in a particular instance will strongly depend on the specific path of the market and the investor’s entry point (or points, in the case of multiple investments), and also that tax law will change over time in ways that are impossible to predict. We discuss how tax considerations impact portfolio re-balancing in more detail in this note here, and we discuss in detail the tax efficiency of a historical Elm investment in this note here.

Each of our strategies follows our rules-based asset allocation methodology, an approach we call Dynamic Index Investing®. Please click here for a note that describes in detail the three main components of this approach: the construction of the Baseline portfolio and the value and momentum overlays to that Baseline portfolio which make the portfolio responsive to changing market conditions.

For an asset class to be included in our Baseline portfolio it needs to be:

- Big and producing undiversifiable risk

- Investible via low cost and liquid vehicles

- Likely to carry a risk premium which ideally should be observable prospectively

- Accessible without requiring specialized selection skill

Asset classes that meet these criteria for our SMA portfolios are public market equities, public market real estate vehicles and government and corporate bonds. Among the many investments that don’t meet these criteria are hedge funds, private equity, venture capital investments, bank loans, volatility indexes, convertible bonds, soft commodities, fine art and other collectibles, and cryptocurrencies. We also do not invest in individual equities.

Our policy is that we do not hedge the FX exposure. For example, when we buy Japanese equities through index funds or ETFs, we hold them without any associated short positions in the Yen/$ exchange rate. So, if the price of Japanese equities in Yen stays constant, but the Yen weakens against the dollar, then Japanese equities will reduce the return of our fund, which we report in dollars. We made this decision for the following reasons:

- Simplicity: we invest in the equity markets of over 60 countries with most of them having their own local currencies. Not all of them have liquid and open FX markets. Furthermore, certain FX markets won’t be well described by Elm’s value and momentum framework, making us cautious in introducing this extra complexity into our approach.

- FX hedging is not clearly risk reducing for countries whose stock markets tend to go down when their currencies strengthen (e.g. those with significant international trade).

- If investors consider themselves global citizens, as many of our investors do, and choose to measure the value of their investments in a global currency unit (albeit with a home bias), FX hedging can also increase risk.

- Negative correlation reduces returns: An FX hedge needs to be adjusted so that it stays in line with the value of the equity market it is hedging. If an equity market tends to go up when its currency weakens (and vice versa), then each rebalancing adjustment will be done at an expected loss to the hedger, as it will be necessary to go short more of the currency when it has weakened and to buy it back when it has appreciated, resulting in a significant drag on returns. Of course, the associated transaction costs are a further drag on returns as well.

- It is very disturbing that a FX-hedged equity investment can lose more than 100% of its value – sounds too much like leverage for us.

For US investors, our Separately Managed Accounts have a $2mm minimum, assessed at the family level. For our private Cayman-domiciled fund, Non-US investors from certain jurisdictions are eligible to invest with a $2mm minimum.

In both strategies, we offer minimum waivers on a case-by-case basis. Please contact us to discuss further.

The primary reason for our $2,000,000 SMA minimum is for us to be able to keep your costs low, in terms of us being able to deliver our services for our annual fee of 0.12% per year.

We are happy to consider accepting ETFs and Index funds you already own into Elm’s investment program for your Separately Managed Account. If the instruments are part of Elm’s current program or can reasonably be mapped into Elm’s program, we will typically accept them. For taxable accounts, on a case-by-case basis, we will also normally help you evaluate the costs and benefits of holding the legacy instrument versus switching to a lower-cost or better-structured similar instrument (if available). Once these assets are accepted into your account, we will routinely evaluate whether to continue to hold them based on all our usual criteria, including but not limited to Elm’s target asset allocation, transactions costs, expenses and tax considerations (for taxable accounts).

We hold assets with the following institutions for each of our products:

For US investors:

• Separately Managed Accounts at Fidelity or Schwab

For non-US investors:

• Our private fund – JP Morgan, Interactive Brokers and Fidelity

Many advisors charge higher, “fat” fees for smaller accounts, and the “right” fee for their largest accounts. At Elm, we simply don’t do that. We view 12bp as the absolute minimum marginal rate we need to charge, and we give that to all clients regardless of their size. We don’t know of any other advisors whose “top-tier” rate is below 12bp, and we have never charged a client less (not including Elm staff and families).

Getting started with Elm is intended to be as painfree as possible.

For US Separately Managed Account clients:

- Using our Online Onboarding, prospective investors can either add Elm to an existing account at Fidelity or Schwab or use our portal to open a new account

- Once your account is open, we’ll work with you to establish your portfolio baseline and dynamic scaling

- Following account funding, the portfolio will be invested during our next weekly rebalance.

For non-US investors in our offshore fund:

- Please contact us to receive the fund’s Private Placement Memorandum and Subscription documents

Elm Is Different

Founded in 2011, Elm manages nearly $2 billion for over 400 families. Our approach was developed by veteran investing professionals who wanted a better way to manage their own family’s wealth. Today, our team—including our founders—invest virtually all of their personal wealth through the same strategies we offer our clients.

We built Elm because we couldn’t find anyone else offering sophisticated, dynamic investment management with the efficiency of index funds. Years later, we still haven’t.